Nigeria's fixed income market, which has seen a surge in yields, is beginning to moderate, and analysts are urging investors to be cautious about locking into high rates for extended periods. While the elevated yields are attractive, experts warn they may be unsustainable, particularly as macroeconomic conditions shift.

“A combination of factors clearly favours a longer-duration fixed income strategy,” noted analysts at CardinalStone in their mid-year outlook. They advise a careful balance between capturing current returns and managing reinvestment risks linked to shorter-dated instruments.

Treasury Bills Yields Set to Fall

At the start of the second half of 2024, many analysts cautioned against focusing solely on high short-term Treasury Bills (T-bills) yields, suggesting investors consider locking in long-term government bonds with rates as high as 21%. CardinalStone expects inflation to dip in the latter half of 2024, prompting a shift towards longer-duration assets.

In the first half of the year, Nigeria’s fixed income market saw yields climb sharply due to the Central Bank of Nigeria’s (CBN) aggressive tightening policies aimed at curbing inflation and managing liquidity. This spike led to a significant rise in interest rates, particularly on short-dated maturities. Average yields on T-bills reached 21.80% and bonds at 18.80%, compared to 11.35% and 14.17% in the same period of 2023.

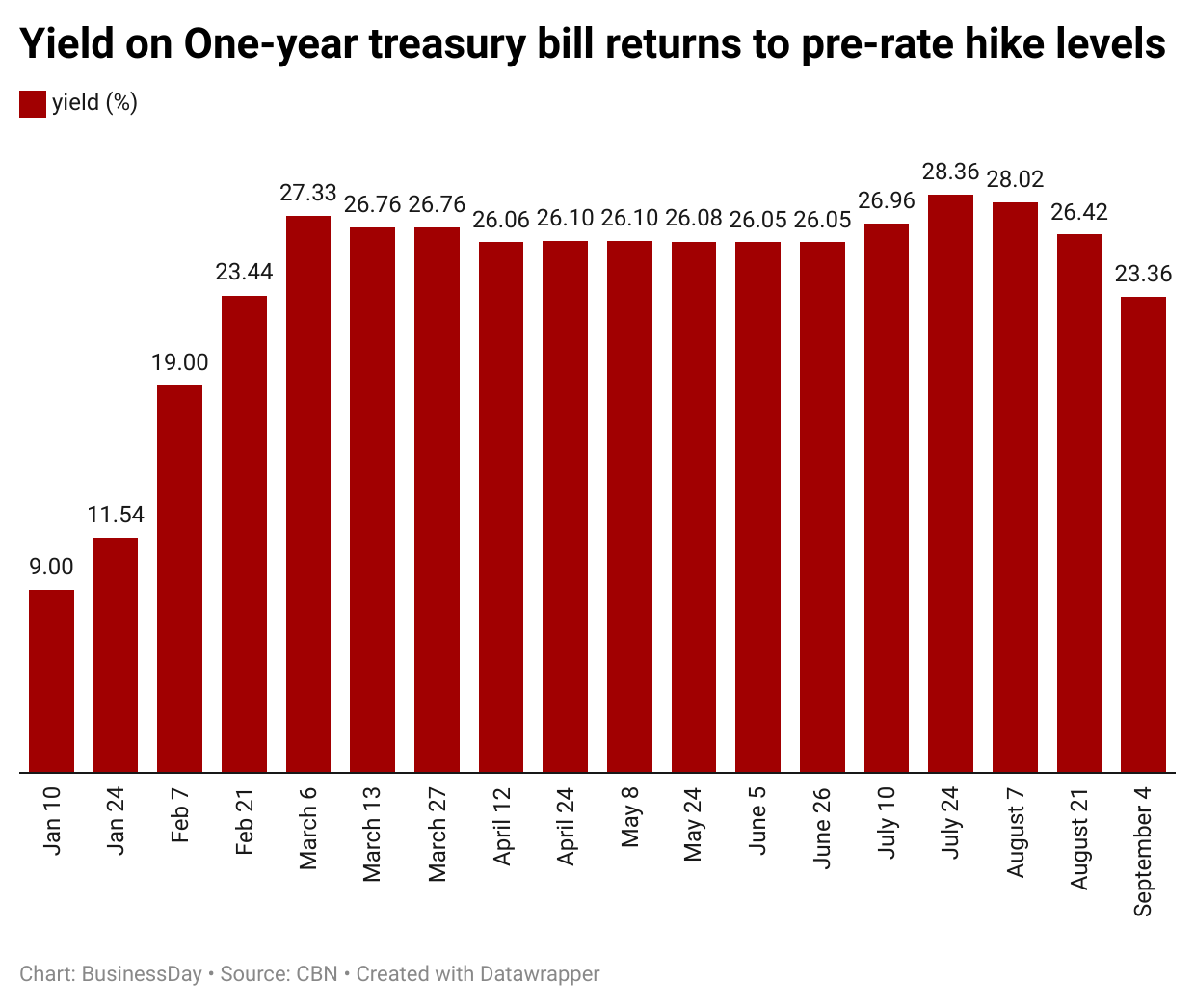

The high yields attracted over $4 billion in foreign portfolio investments into the Nigerian debt market. However, T-bill yields have since started declining, dropping from a high of 28.36% in July to 23.36% by August, as investors rushed to secure returns before further declines.

Falling Inflation and High Borrowing Costs Drive Yield Reductions

Meristem, in a recent report, noted that while fixed income yields are expected to hover around current levels, the government’s need to moderate borrowing costs could drive them down further. With inflation projected to decrease in the second half of 2024, the gap between negative real returns and inflation could narrow.

For the first time in 19 months, Nigeria’s headline inflation rate dipped to 33.40% in July, easing fears of further rate hikes. This shift, coupled with high foreign portfolio investment inflows, may result in the largest total capital inflow in four years, according to Meristem analysts.

Yield Curve Moderation Expected

CSL Stockbrokers also foresee a moderation in the yield curve for Nigerian fixed income instruments, driven by higher base effects, improved foreign exchange stability, and liquidity. Foreign portfolio investments are expected to remain subdued until the FX market stabilises, though a sharp drop in fixed income rates is not anticipated.

With the Debt Management Office (DMO) having already raised over N12 trillion of its projected N20 trillion for the year, CSL analysts predict a 50-100 basis points reduction across the yield curve in the second half of 2024.

Locking in Long-Term Returns

Meristem recommends that investors focus on long-duration instruments, particularly government bonds, to capitalise on the current high yields and avoid the reinvestment risks associated with short-term instruments. They forecast a gradual decline in yields through 2025, making it crucial for investors to lock in these favourable rates now.

With the market showing signs of a potential downturn in yields, experts agree that a long-term strategy is key to maximising returns in Nigeria’s fixed income space.