Nigeria’s petrol pricing system has long been a topic of public discourse, shaped by government intervention through fuel subsidies, marketers’ price wittiness, and in some cases policy arbitrariness. For many decades, the government has regulated petrol prices through subsidy initiatives to keep it affordable for its citizens, often at the cost of significant fiscal strain on the national budget. As at 2023, fuel subsidy has gulped a whopping #6trillion between 2022 & 2023, according to the Accelerated Stabilization and Advancement Plan (ASAP) report presented by the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edu, to the President in June 2024. According to the report, “At current exchange rates, expenditure on fuel subsidy is projected to reach N5.4 trillion by the end of 2024. This compares unfavourably with N3.6 trillion in 2023 and N2.0 trillion in 2022,”

In recent years, the move towards deregulation has gained momentum as the government seeks to allow market forces to dictate fuel prices. This shift aims to reduce the financial burden of subsidies, encourage private sector participation, and stimulate competition in the petroleum sector. However, the deregulation process has sparked debates about its benefits and challenges, particularly its effect on the cost of living and inflation.

The debate over fuel subsidies in Nigeria presents a complex and often contradictory narrative. For decades, Nigerians have called for the removal of the inefficient subsidy system, citing its role in draining government finances, fostering corruption, and distorting the economy. Critics argue that fuel subsidies disproportionately benefit the wealthy, promote smuggling to neighboring countries, and deter investment in refining and infrastructure. The argument for subsidy removal gained traction, especially as the Nigerian government faced economic downturns and fiscal challenges due to fluctuating global oil prices.

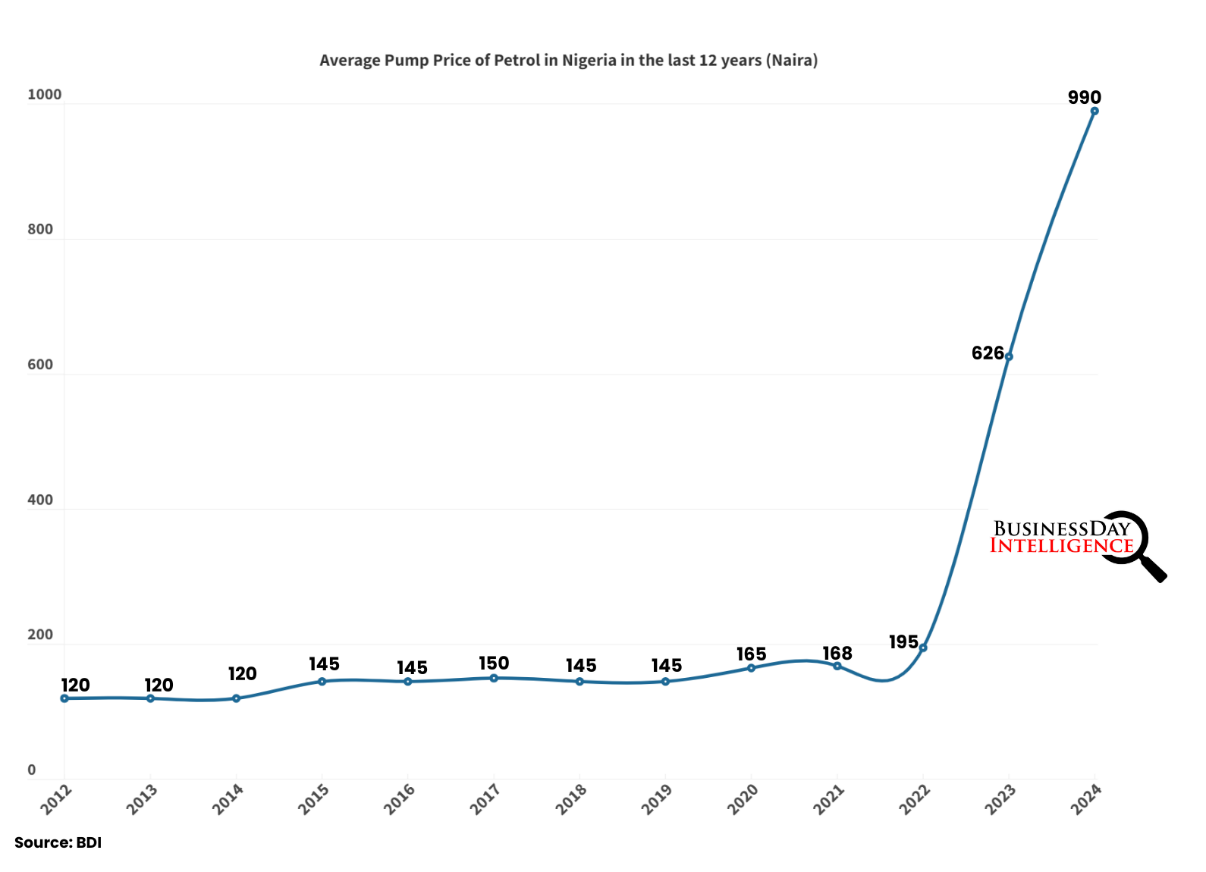

However, the aftermath of subsidy removal has sparked widespread discontent, leading to a growing demand for its reinstatement. Rising global oil prices, coupled with the depreciation of the naira, have pushed fuel prices to record highs. This has resulted in an increased cost of living, with transportation and food prices soaring, placing immense pressure on households and small businesses. For many Nigerians, the removal of the subsidy has translated into hardship, fueling calls for its return as a safety net to cushion the impact of high petrol prices.

In this piece, we aimed to evaluate the impact- and more crucially the effectiveness-of petrol price deregulation on the Nigerian economy with a focus on the newly announced petrol pump price in Nigeria.

Historical Trajectory of Petrol Pricing in Nigeria

Nigeria’s petrol pricing system has been heavily influenced by the government’s subsidy policies, dating back to the 1970s. Initially, fuel subsidies were introduced to shield consumers from fluctuating global oil prices, ensuring that petrol remained affordable for the population. As a major oil producer, Nigeria was in a unique position to offer subsidized fuel prices, positioning it as one of the few countries where petrol was sold far below global market rates.

However, this system came with significant challenges. Over the decades, fuel subsidies have put immense pressure on the national budget, diverting resources that could have been invested in infrastructure, education, or healthcare. The artificially low prices also encouraged smuggling to neighboring countries, where fuel was sold at higher prices. Additionally, the subsidy system fostered inefficiency and corruption, as a lack of transparency made it difficult to monitor fuel importation and distribution.

Several key turning points led to calls for deregulation. The first major attempt was in 2012, when the government announced the removal of subsidies, sparking widespread protests and strikes. Public resistance forced a partial reinstatement of the subsidies. However, the economic strain of maintaining subsidies, especially during periods of low oil prices, continued to mount. By 2020, faced with dwindling revenues and rising debt, the government once again moved toward deregulation, allowing petrol prices to be determined by market forces.

The push for deregulation was driven by the need for economic reform, fiscal sustainability, and the desire to attract private investment into the downstream petroleum sector. Despite its challenges, deregulation remains a crucial part of Nigeria’s economic agenda, aimed at creating a more transparent and competitive fuel market.

The Quandary

Nigeria’s oil sector has historically been characterized by government-controlled prices, subsidies, and inefficiencies. This has forced many Nigerian to demand for the removal of what is widely perceived as the “hydra-headed” monster clogging the wheel of development in nation.

The persistent call for fuel subsidy removal in Nigeria stems from the belief that subsidies distort the economy, drain public funds, and foster corruption. Economists and reform advocates argue that removing subsidies allows market-driven pricing, promotes competition, and attracts investment into the petroleum sector. In 2020, the Nigerian government officially removed fuel subsidies, aiming for fiscal stability and sectoral reform. However, this move led to increased fuel prices driven by global oil markets and a weakened naira, significantly raising the cost of living for Nigerians.

Towards the end of 2023, not long after the Presidential announcement bombshell during his inauguration, speculations were strife that the Nigerian government had quietly reintroduced petrol subsidies to keep the pump price at an average of N617, amidst the rising cost of crude oil and a depreciating naira. Although the government repeatedly denied the reinstatement, Festus Osifo, President of PENGASSAN, claimed on October 6, 2023, that subsidies were indeed being paid due to higher crude oil prices, which had increased from around $80 to $93 per barrel, necessitating price adjustments.

NNPC Limited, however, maintained that no subsidies were in place, with Group CEO Mele Kyari asserting that the company was recovering the full cost of imported products. Despite this, former Kaduna State Governor Nasir El-Rufai echoed Osifo's view, stating that regardless of official admissions, the landing cost of petrol indicated a form of subsidy was still being paid. This was later confirmed by the nation’s oil giant through its Chief Corporate Communication Officer-Mr. Olufemi Soneye on the eve of Dangote Refinery shipping- 1st September, 2024

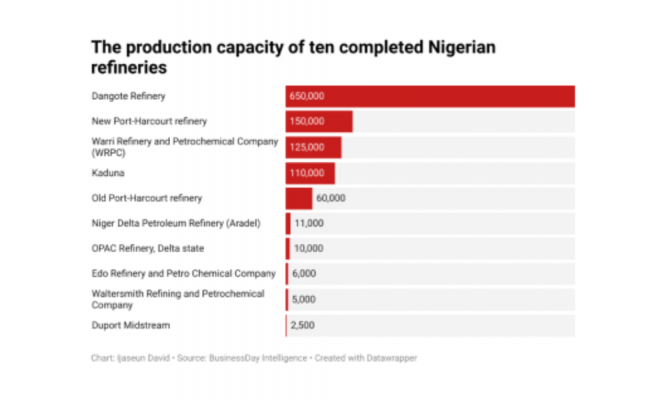

So, on 15th September 2024, as Nigerians are basking in the news of the nation’s major oil distributor- the Nigerian National Petroleum Company started offloading of petroleum product from the much-anticipated Dangote Refinery, the estimated pump-price template released sent heebie-jeebies across the nooks and crannies of the nation. The pricing template- which stirs a domino effect of controversy- ranges between N950.22 in Lagos to the highest of N1,019.12 in Borno State. Tellingly, NNPC provided a breakdown of the component that added up to the total sum but this is only made for Lagos State-the ground zero of production.

The recent adjustment of the petrol pump price in Nigeria has reignited the debate on the effectiveness and feasibility of petrol price deregulation. In 2020, the Federal government of Nigeria announced the deregulation of the downstream segment of the petroleum sector aiming to liberalize the market and allow market forces to determine prices. Needless to reiterate that the petroleum industry is segmented into the upstream, midstream (both are onshore components), and downstream

Estimated Pump Price in Nigeria as at 17/9/2024

Source: NNPC Corporate Retail

This development which generated a retinue of opprobrium squarely left us wondering what Nigerians truly want!

As petrol prices soared, public discontent grew, leading to renewed calls for the reinstatement of subsidies. Many Nigerians, particularly lower-income households and small businesses, have struggled with the financial burden of higher fuel costs, sparking demands for government intervention. The dilemma lies in balancing economic reform with social welfare, as the removal of subsidies—though economically justified—has had harsh immediate impacts on the population, highlighting the need for more nuanced policies to ease the transition.

BDI Commentary

The new pump price presents a mixed picture. While deregulation has reduced subsidy payment and attracted investment, it has aslo introduced inflationary pressures and uneven distribution of profits. To fully evaluate the effectiveness of the market-determined pricing regime, policymakers must monitor market dynamics and adjust polciies accordingly, implement inflationary-mitiogating measure, and ensuring of consumer protection mechanism.