There’s no trace of the $30 billion Foreign Direct Investment that Nigerian President Bola Tinubu claimed the country has attracted in the last one year of his economic reforms.

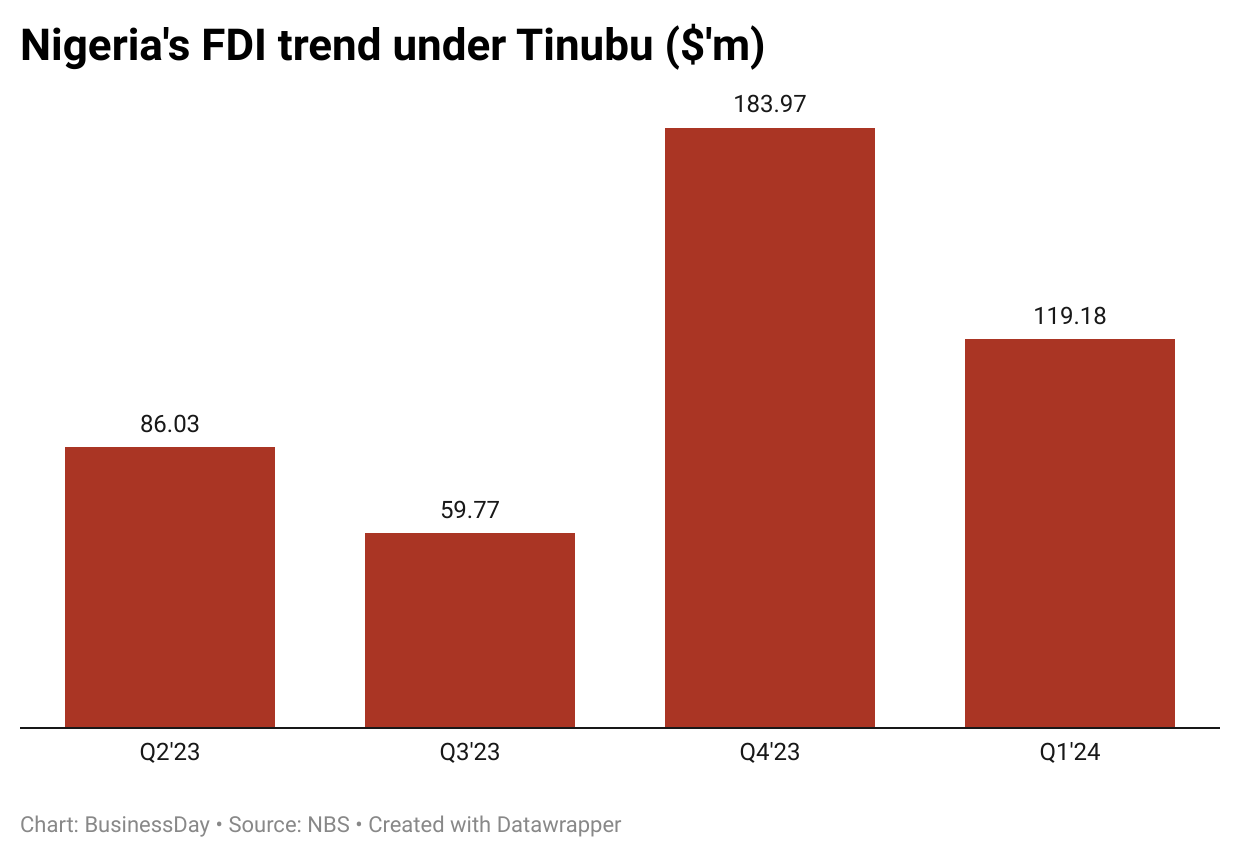

Data from the National Bureau of Statistics (NBS) revealed that Nigeria attracted a total of $377.3 million in Foreign Direct Investment (FDI) in the whole of 2023 and has received $119.18 million in the first quarter of 2024.

Nigeria’s biggest FDI haul in the last ten years was in 2014 when it attracted $2.28 billion, according to NBS data.

At no point since a transition to democratic rule in 1999 has the country attracted $30 billion in a single year. Not even UNCTAD, which tends to report higher FDI figures for Nigeria compared to the NBS, has ever captured a single year FDI inflow of $30 billion.

According to UNCTAD, Nigeria attracted $1.87 billion in 2023 as against the $377.3 million reported by the NBS.

The entire West African region attracted $13 billion in 2023 and Nigeria did not even get the largest share of the FDI pie, with Senegal attracting $2.64 billion compared to Nigeria’s $1.87 billion.

Egypt, which has become the biggest recipient of FDI in Africa, attracted $9.8 billion in 2023. Egypt’s haul is only a third of what President Tinubu claimed Nigeria attracted.

"Thanks to the reforms, our country attracted foreign direct investments worth more than $30 billion in the last year,” Tinubu said in an independence day broadcast on Tuesday. Nigeria turned 64 on the day, having attained independence from British rule on October 1, 1960.

No sign of $30bn in external reserves

Tinubu’s $30 billion FDI inflow claim has also not shown up in the Central bank’s external reserve data.

The CBN reported external reserves of $37 billion as at the end of September.

Analysts who spoke to BusinessDay said if Nigeria indeed attracted $30 billion worth of FDI, the country’s foreign reserves should be in the region of $50 to $60 billion.

This, according to the analysts, will in turn give the naira the needed boost and consequently slow inflation.

But the naira has endured a painful journey under Tinubu. The currency which was initially devalued in June 2023 has lost over 70 percent of its value since then.

Investment pledges are not investments

Tinubu was probably referring to investment commitments from his trips to India, France and UAE instead of actual investments, according to Ayo Teriba, CEO of Lagos-based consulting firm, Economic Associates.

“I think the president needs to clarify this because ‘attracted’ and 'received’ are two different things,” Teriba said.

Last September, Nigeria secured nearly $14 billion of pledges from Indian investors and seeks an economic cooperation pact with the South Asian nation, according to a statement by Ajuri Ngelae, former presidential spokesperson.

India's Jindal Steel and Power committed to pump $3 billion into Nigeria's steel sector and Indorama Corp plans to invest an additional $8 billion to expand its petrochemical facility in the West African country.

Recently, Coca Cola Hellenic Bottling Company disclosed plans to invest $1 billion in Nigeria in expansion of its business in over five years.

Meanwhile, ExxonMobil equally announced a $10 billion investment pledge into Nigeria's deep-water oil operations at a meeting on the side-lines of the 79th Session of the United Nations General Assembly (UNGA) in New York, United States.

“The government is possibly calculating the pledges because there's no way a $30 billion investment can get into the country without having swelling impact,” an investment banker said.

Teriba said Nigeria is in dire need of investments to shore up its 'very little' $37 billion FX reserves, adding that pledges won't do the magic.

Further analysis of the capital importation data from the NBS showed that Nigeria's FDI, despite rising by about 150 percent on a year-on-year basis, declined by 35 percent from $183 million in Q4 2023 to $119 million between January and March this year.

A breakdown of the report revealed that FDI recorded the lowest of the total capital importation even as total foreign investments tripled and hit a four-year high of $3.38 billion in Q1.

“Even countries with the best business environments will work hard to secure $30 billion in FDI in one year,” a senior economist in a government-owned institution said.

Indonesia, Southeast Asia’s biggest economy and a manufacturing powerhouse, was one of the top 20 recipients of FDI globally in 2023 yet it attracted $22 billion, which is still less than Tinubu’s $30 billion claim.

“The Nigerian government is counting its chickens before they hatch. Where did they see the data? How can we have a $30 billion investment and we still have a lingering FX crisis?” a financial economist who did not want his name in print said.