The road to economic reform is rarely smooth, and Nigeria’s current efforts are no exception. Like an echo from the past, the country’s latest market adjustments stir memories of the 1986 Structural Adjustment Programme, with similar growing pains emerging once again.

But while Nigeria struggles with rising inflation, a weakened currency, and public unrest, lessons from Indonesia’s reform journey offer a glimmer of hope. Asia’s largest archipelago has weathered similar storms, providing valuable insights on how Nigeria might navigate these challenges more effectively.

The various market reforms introduced by the Nigerian government currently appear to be bearing not-so-desired fruits, much like the implementation of the Structural Adjustment Programme of 1986.

Lessons from one of Asia’s giant economies, Indonesia, offer key ways for the most populous nation in Africa to improve its ongoing reforms and set the economy on the right path.

“What differentiated Indonesia’s strategy from Nigeria’s was its implementation of targeted social welfare programmes.”

The shadow of 1986

“The productive structure of an economy is an important input into the reform process and outcomes,” said Adeola Adenikinju, president of the Nigerian Economic Society (NES) at the NES’ 65th annual conference in Abuja on Wednesday.

Adenikinju stated that while embarking on market reforms, “many of Nigeria’s macroeconomic indicators are showing similar patterns as observed during the implementation of the Structural Adjustment Programme of 1986,” Adenikinju said.

The Structural Adjustment Programme (SAP) was a set of economic policies implemented by the Nigerian government under the guidance of the International Monetary Fund (IMF) and the World Bank during the mid-1980s.

The programme began in 1986 under the military regime of General Ibrahim Babangida and was primarily aimed at addressing the economic crisis that had plagued the country due to falling oil prices, rising debt, and a deteriorating economy.

The report showed that the economic reforms, aimed at providing a leveller for Nigeria’s economy to kickstart and drive in runaway investments, have stoked prices, led to depreciation of the naira, and deteriorated consumer spending.

President Bola Tinubu announced the removal of a costly petrol subsidy that kept prices artificially low in May 2023 during his inauguration. In June of the same year, his government unified the exchange rate and allowed the naira to trade more freely.

These policies, met with mixed reactions, have contributed to a significant depreciation of the local currency, making it one of the weakest in the global market.

It has equally hammered the purchasing power of the citizens and resulted in widespread public discontent, with many calling for the rollback of the reforms.

NES stated that FX depreciation boosted revenue through exchange rate gains. Higher costs in terms of external debt servicing, energy, and capital projects with FX exposure have ensued.

Just like during the SAP period 38 years ago, according to the report, the naira was devalued. This led to the surge in imported raw materials, increased cost of production, and consequently, prices of domestic goods.

“Two years after the implementation of SAP, the naira had lost 48.5 percent of its value. This is similar to the present case, where naira has lost much more, i.e., 71.15 percent,” the UI don said.

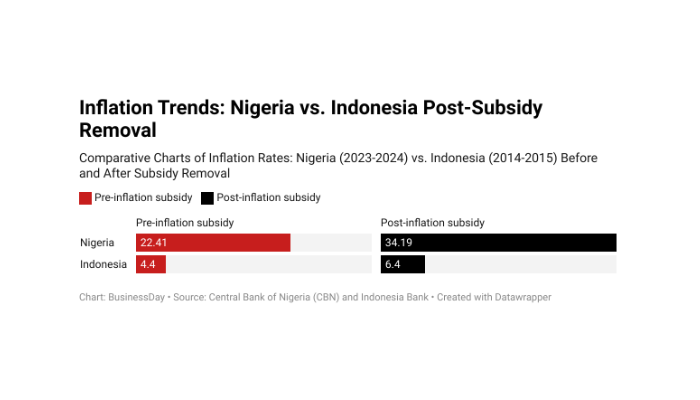

The report further revealed that inflation rose in the immediate post-SAP period in Nigeria, indicating how the structural programs had pushed prices from 16.16 percent to 38.76 percent.

Lessons from Indonesia

Indonesia’s experience offers a more measured approach to subsidy removal. Like Nigeria, Indonesia sought to reduce its fuel subsidies to foster sustainable growth, redirecting funds from gasoline price controls to capital investments.

However, Indonesia’s execution of these reforms stands out for its gradual pace and targeted safety nets, designed to cushion the poor from the immediate impact of rising fuel prices.

After several unsuccessful attempts, by January 2015, the country had removed most of its gasoline and diesel subsidies. Though not without challenges—fuel prices surged by 30 percent, and inflation rose from 4.4 percent to 6.4 percent—the phased approach helped mitigate social unrest and opposition.

What differentiated Indonesia’s strategy from Nigeria’s was its implementation of targeted social welfare programmes. These safety nets softened the blow for the most vulnerable, ensuring that public protests, though inevitable, did not spiral out of control.

In contrast, Nigeria’s reforms have lacked such social buffers, contributing to widespread discontent.

The long-term gains from Indonesia’s reforms became evident over time. Subsidy savings, amounting to approximately IDR 211 trillion (USD 15.6 billion), were reallocated to infrastructure projects and social services, including education and healthcare, fuelling broader economic development.

These investments laid the groundwork for sustained growth, pushing Indonesia’s GDP from $860.9 billion in 2015 to $1.37 trillion by 2023, according to World Bank data.

The role of Bank Indonesia

Crucial to Indonesia’s reform success was the role of Bank Indonesia, the central bank. During the fuel subsidy removal, the country’s exchange rate floated freely, akin to Nigeria’s current system.

However, unlike Nigeria, where central bank intervention has been limited, Bank Indonesia actively managed the currency, intervening to curb volatility and maintain investor confidence.

The floating exchange rate exposed the Rupiah to depreciation pressures, but Bank Indonesia’s timely interventions, combined with interest rate adjustments, helped control inflation and stabilise the economy.

The strategic involvement of the central bank proved critical in managing short-term shocks while maintaining long-term economic stability. Nigeria’s Central Bank (CBN) could draw on these lessons to better manage its own transition.

Broader Implications for Nigeria

Indonesia’s experience underscores the importance of a phased approach to economic reforms, combined with social safety nets and robust central bank intervention. Nigeria’s current reforms, though necessary, may benefit from a similar strategy.

By rethinking the speed and scope of subsidy removals and directing savings into social welfare programs and infrastructure, Nigeria could improve the long-term outlook of its economy.

According to the World Bank, Indonesia’s GDP is expected to grow at an average rate of 5.1 percent annually from 2024 to 2026. This growth, coupled with the country’s ranking as the 10th largest economy by purchasing power parity, reflects the positive outcomes of its reform efforts.

For Nigeria, the path forward may require balancing bold reforms with measures that protect its most vulnerable citizens while leveraging central bank interventions to ensure economic stability.

Oluwatobi Ojabello, senior economic analyst at BusinessDay, holds a BSc and an MSc in Economics as well as a PhD (in view) in Economics (Covenant, Ota).

Wasiu Alli is a business and finance journalist at BusinessDay who writes about the economy, business trends, and politics. He holds a BA. Ed. and M. Ed. in English Language and Education.