OLUWOLE CROWTHER

Business was not as good as the 28 percent profit increase in 2023 reported by the Nigerian National Petroleum Company Limited (NNPCL) suggests.

The naira devaluation made the state-oil firm’s profit swell but when converted to dollars, the currency in which the firm does the better part of its business, there was a 14 percent decline.

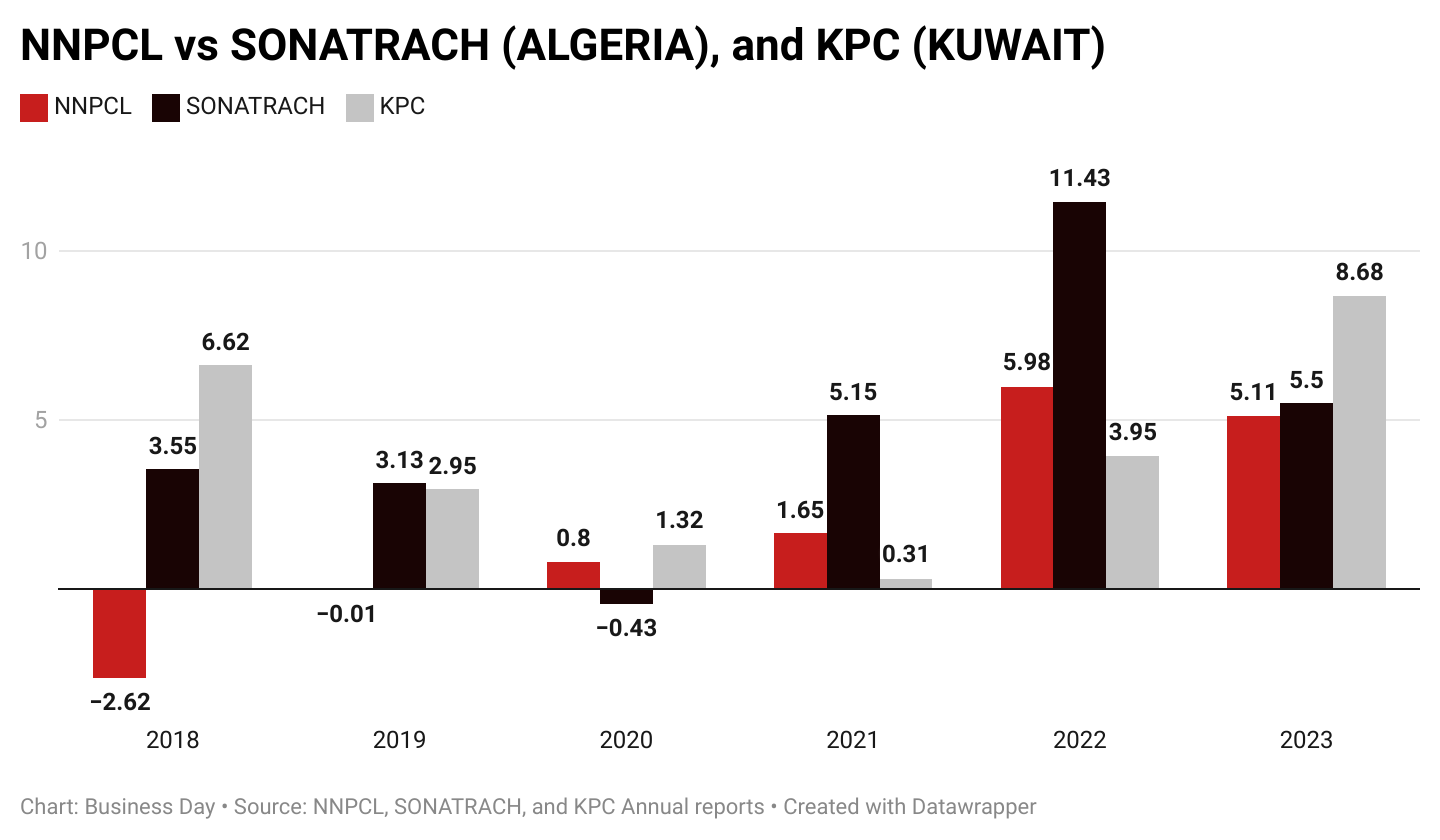

In 2022, NNPCL declared a profit of N2.548 trillion, equivalent to $5.981 billion at the average exchange rate of 425.98/$ at the time.

The 2023 profit of N3.3 trillion equates to $5.110 billion, marking a 14.57 percent decline in dollar terms compared to 2022’s figure.

Nigeria ended a costly petrol subsidy practice that ate into the profits of the NNPCL in 2023, but the gain of the removal was muted in the accounts. Analysts say the reason why the impact of the subsidy removal was not pronounced on NNPCL’s bottomline is because the practice returned after the exchange rate weakened.

Comparatively, other national oil companies also faced challenges last year. Saudi Aramco's profit dropped from $161.068 billion in 2022 to $121.271 billion in 2023, a 25% reduction.

Algeria’s Sonatrach saw its profit shrink from $11 billion in 2022 to $6 billion in 2023. However, Kuwait Petroleum Corporation (KPC) managed a 123% profit increase, from $3.9 billion in 2022 to $8.7 billion in 2023.

Expectations were higher for NNPCL, particularly when comparing its performance to other OPEC member countries.

This optimism was fueled by reforms initiated by former President Muhammadu Buhari, who converted NNPCL into a limited liability company in accordance with the Petroleum Industry Act (PIA) in 2022.

The aim was to position NNPCL to compete favourably with industry giants such as Saudi Aramco, Algeria's Sonatrach, Kuwait Petroleum Corporation (KPC), and Libya's National Oil Corporation. Yet, NNPCL still appears to be struggling on the global stage, suggesting that the expectations may have been overly ambitious.

NNPCL still has some ground to cover on OPEC peers, some of whom pump more oil.

NNPCL suffered losses between 2018 and 2019 and has been on a slow profit trajectory since 2020. On average, Sonatrach ($4.72 billion) and KPC ($3.97 billion) have outperformed NNPCL’s average profit of $1.82 billion.

NNPCL’s historical journey reflects the complexities of the oil industry. Originally established as the Nigerian National Oil Corporation (NNOC) in 1971, it evolved into NNPC in 1977 and transitioned into NNPCL, a limited liability company, in July 2022 under the PIA. Despite these changes, NNPCL still lags behind its peers in operational efficiency and profitability.

Saudi Aramco, with its vast reserves and production capabilities, continues to set benchmarks that others struggle to meet. Saudi Arabia boasts the highest OPEC production allocation, about 10.4 million barrels per day (b/d), while Nigeria’s allocation is 1.7 million b/d. Nigeria's inability to meet its allocation consistently, due to security challenges and oil theft, further hampers NNPCL’s performance.

Nowhere near peers

Financial analysis highlights NNPCL’s inefficiencies. The company’s asset turnover was a mere 9.72% in 2023, compared to Saudi Aramco’s 74.92% and KPC’s 82.67% in the same year.

Asset turnover ratio is a measurement that shows how efficiently a company is using its owned resources to generate revenue or sales. The ratio compares the company's gross revenue to the average total number of assets to reveal how much sales was generated from every dollar of company assets.

Additionally, NNPCL’s quick ratio—an indicator of liquidity—was 0.9, signalling liquidity problems and the company’s inability to cover short-term obligations. In contrast, Saudi Aramco maintained a quick ratio of over 2.0.

NNPCL’s financial struggles are compounded by underutilised assets, including refineries that have generated no revenue but continue to drain resources. These inefficiencies call for strategic divestments and improved corporate governance. Industry experts suggest that NNPCL needs to optimise its debt-to-equity ratio and ensure better financial management by depositing crude oil sales proceeds directly into accounts with the Central Bank of Nigeria (CBN).

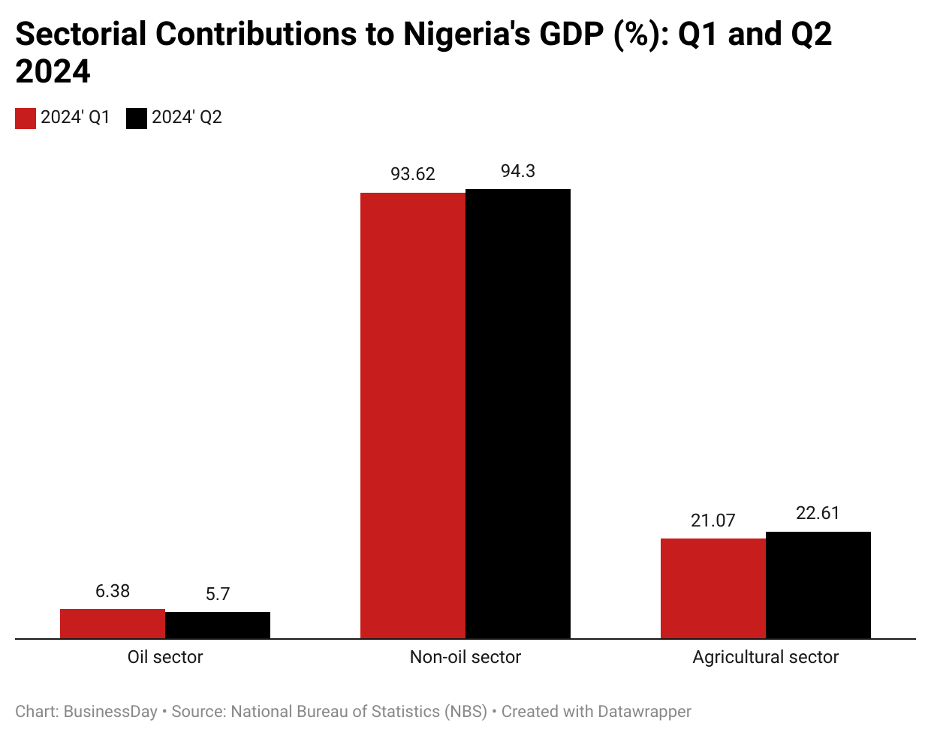

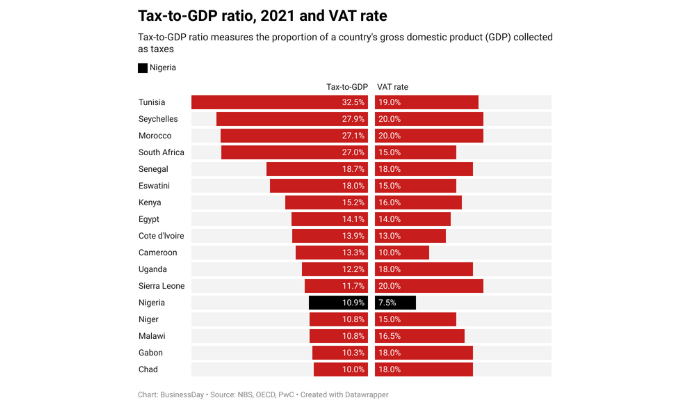

NNPCL’s role in Nigeria’s economy is pivotal. At its peak, oil contributed about 70% of the nation’s revenue and accounted for 95% of foreign exchange earnings. For NNPCL to fulfil its strategic importance, it must navigate these challenges with increased efficiency and transparency. The company's future lies in its ability to reform and innovate, ensuring it doesn’t just compete but thrives on the global stage.