Nigerian Breweries Plc, the largest brewer in Nigeria, is currently raising N600 billion through a rights issue aimed at clearing its N500 billion foreign exchange (FX) debt. The company has been grappling with FX losses in the face of Nigeria's persistent dollar scarcity.

"The tough business landscape, characterised by double-digit inflation, naira devaluation, FX challenges, and reduced consumer spending, has impacted many businesses, including ours," said Hans Essaadi, Managing Director/CEO of Nigerian Breweries Plc, after the company obtained approval from the Securities and Exchange Commission (SEC) for its rights issue of 22,607,491,232 Ordinary Shares of N0.50 each at N26.50 per share.

Nigerian Breweries has been dealing with rising costs, mounting debt, and significant FX losses. However, the company believes this rights issue will provide much-needed relief, enabling it to settle its FX-denominated debt, improve its capital structure, and boost operational efficiency. Lagos-based analysts at Meristem noted that this strategic move will help the company stabilise financially and position it for long-term growth in challenging market conditions.

The rights issue, which opened on September 2, 2024, will close on October 11, 2024. Existing shareholders are entitled to 11 new shares for every 5 ordinary shares held as of July 12, 2024. This initiative is part of Nigerian Breweries' recovery plan to deleverage its balance sheet, eliminate certain FX exposures, and reduce bank borrowings, ultimately giving the company greater financial flexibility for future growth.

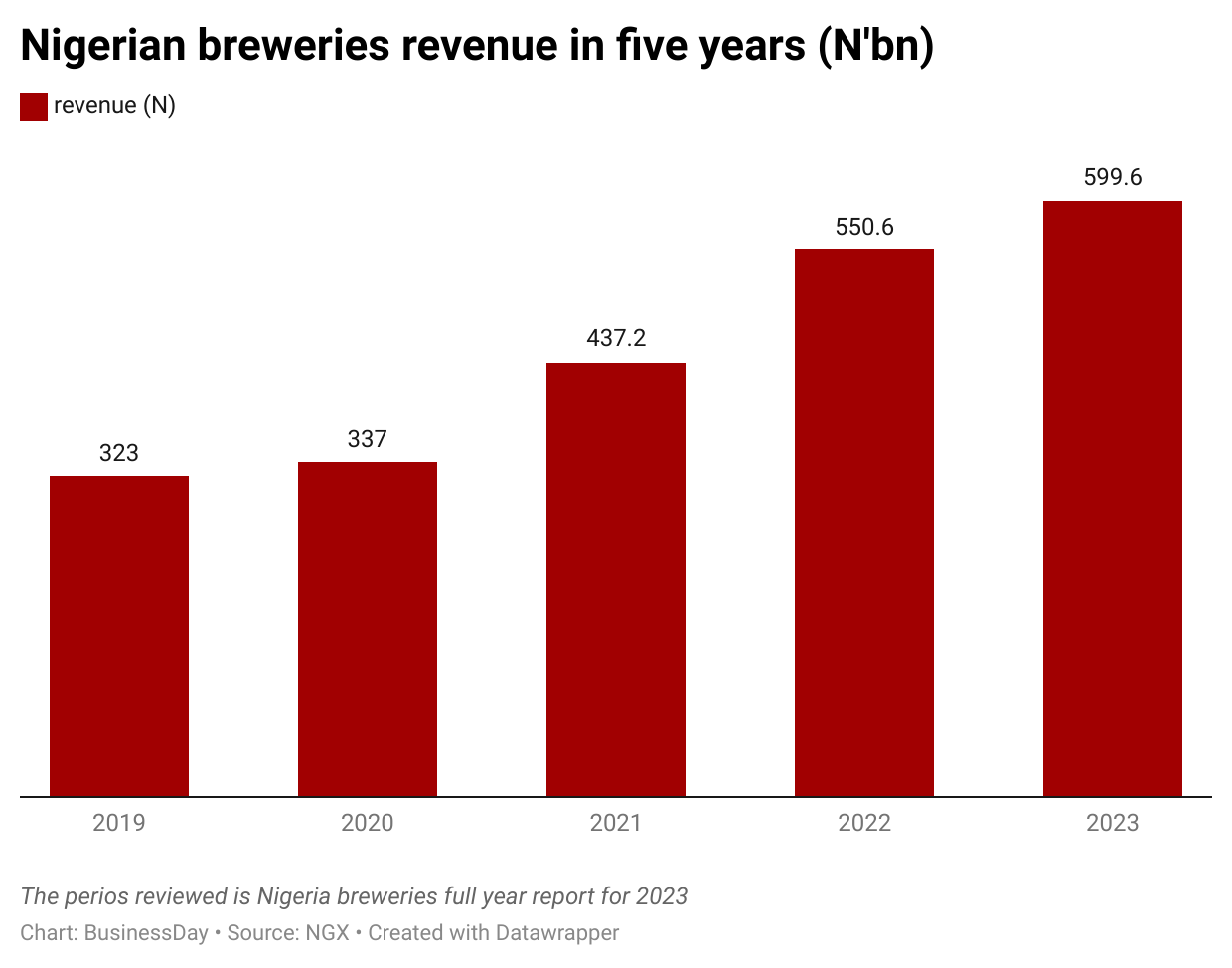

Revenue growth fails to offset declining bottom line

Nigerian Breweries' half-year financial results, ending June 30, 2024, revealed a Loss After Tax (LAT) of N85.199 billion, a 79 percent increase from the LAT of N47.599 billion in H1 2023. Although group revenue surged by 72.9 percent to N479.767 billion from N277.419 billion in H1 2023, net finance expenses spiked by 60.5 percent to N154.480 billion from N96.223 billion, largely due to FX losses.

Oluebube Nwosu, an equity research analyst at Vetiva, advised investors to buy the stock, noting a target price of N31.42 per share, compared to its then-current price of N26.40. "For the full year, Nigerian Breweries is expected to leverage its strong market position and higher pricing to drive revenue growth. However, rising operating expenses and financial costs will continue to pose challenges," Nwosu said.

Market Dominance and FX Challenges

Nigerian Breweries dominates the Nigerian beer market, holding approximately 60 percent market share following its 2014 merger with Consolidated Breweries. Heineken holds a 52 percent controlling stake in the company. Despite its market dominance, the company has faced operational challenges in managing production costs due to inflation and FX losses.

In Q2 2024, Nigerian Breweries saw a 64 percent year-on-year (y/y) revenue increase to N252.6 billion, driven by higher pricing and portfolio optimisation. However, gross profit grew only by 14 percent y/y, as inflationary pressures and increased operating expenses took their toll. The company's Earnings Before Interest and Tax (EBIT) declined by 52 percent y/y to N12.9 billion, while net finance expenses dropped by 17 percent due to reduced FX-related losses. Despite these efforts, Nigerian Breweries posted a net loss of N33.1 billion for Q2 2024.

Highest-ever revenue in H1 2024 amid mounting losses

For H1 2024, Nigerian Breweries achieved its highest-ever revenue for a six-month period, reaching N479.8 billion, a 73 percent y/y increase driven by sustained price hikes. Despite this, gross profit rose slower, by 42 percent, and operating expenses jumped by 46 percent y/y to N124.2 billion, primarily due to inflationary pressures.

Net finance expenses surged by 61 percent y/y to N154.5 billion, leading to a net loss after tax of N85.2 billion for H1 2024. Nigerian Breweries’ net debt increased to N543.6 billion by the end of H1 2024, up from N302 billion at FY 2023, while its equity position turned negative at N21.2 billion.

Resilience in a tough operating environment

Following the release of its half-year results, Nigerian Breweries acknowledged the challenging business environment characterised by soaring inflation, exchange rate volatility, security issues, and rising input costs. Despite these challenges, the company showed resilience, with revenue growing 73% compared to the same period in 2023, driven by strategic pricing and market recovery. Gross profit grew by 42%, although lagging behind the revenue growth due to inflation and currency devaluation impacting the cost of goods sold.

Light at the end of the tunnel

Hans Essaadi, Managing Director/CEO of Nigerian Breweries, reiterated the company’s resilience, stating: “Despite the challenging external environment characterised by high inflation and escalating operating costs, Nigerian Breweries is on the path to recovery.” He highlighted that revenue growth was driven by strategic pricing, innovation, and market recovery, despite increased costs in sales, distribution, and administration.

Essaadi also confirmed the company’s plan to raise N600 billion in additional capital to eliminate foreign exchange-denominated debts and reduce local debts, enhancing the company's operational and financial stability.

Uaboi Agbebaku, Legal Director and Company Secretary of Nigerian Breweries, speaking on behalf of the board, reaffirmed the company’s long-term strategy to deliver value to shareholders. "We remain confident in our enduring commitment to Nigeria through people development, strategic innovation, operational efficiency, and community impact," he said.