…Yield on one-year OMO bill hits 32%

…Naira rebounds to N1576/$

...CBN sells $60m to banks

The Central Bank of Nigeria (CBN) on Thursday sold 364-day OMO bills — patronised by banks and offshore investors — at a yield of 32 percent, the highest since the apex bank began selling the bills.

The record yield on the one-year OMO bill is the CBN’s latest attempt to halt the naira rout by offering higher returns to attract foreign portfolio investments.

The 32 percent yield on the one year OMO bill means foreign investors get returns that just about match the 32 inflation rate in August.

It’s the closest the yield on any government instrument in Nigeria has come to inflation in more than nine years.

Naira rebounds to N1576/$

The naira did close stronger on Thursday, gaining 5 percent to end the day at N1576/$, according to data by FMDQ Securities Exchange, which tracks the data.

Traders however told BusinessDay that the apex bank had sold some dollars to banks just before the close of trading.

“They sold $1-2 million each to banks at 1570-1580 at the close,” one of the traders who did not want to be named said.

"The CBN sold over $60 million but will need to sell again tomorrow and Monday," another trader told BusinessDay.

The $60 million sold represents 18 percent of the total $334.05 million market turnover on the day. According to FMDQ, turnover jumped 232 percent on Thursday compared to the previous day.

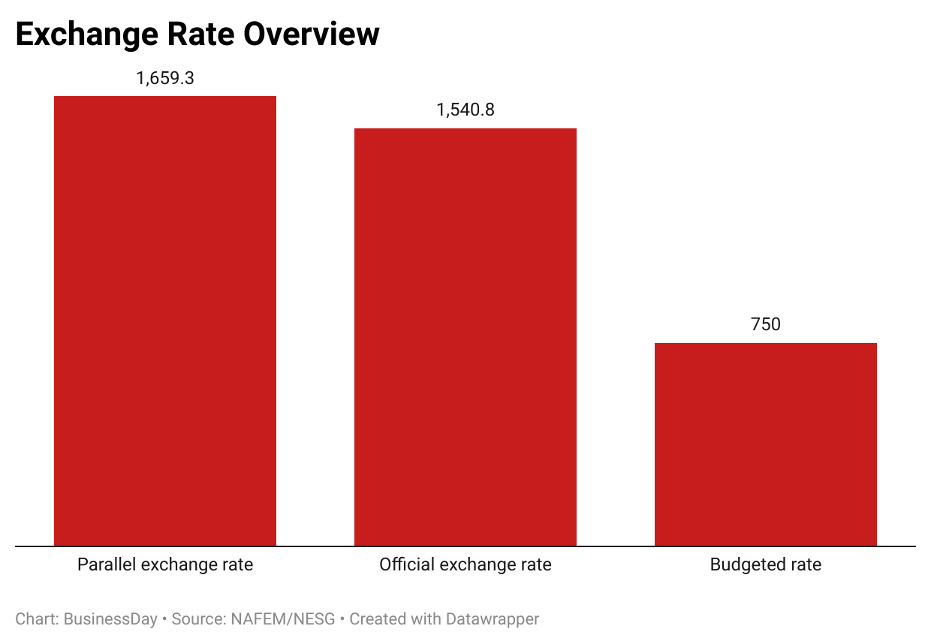

The intraday high which traders say is a better reflection of the market exchange rate was N1699/$, about the same level as the day before.

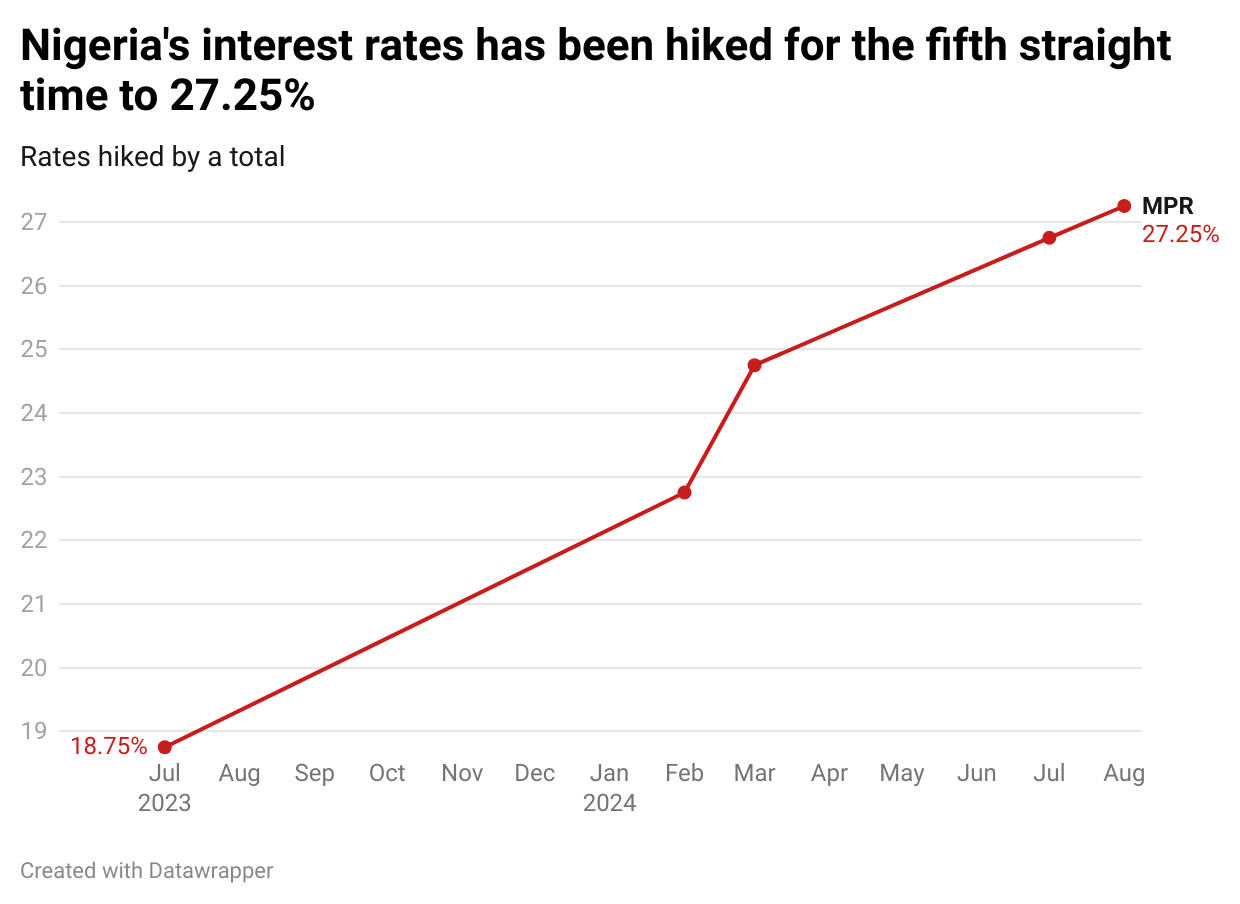

The embattled naira had been on a three-day losing streak going into Thursday, defying the CBN’s surprise 50 basis points hike in benchmark interest rate/MPR on Tuesday.

The latest rate hike, the fifth in quick succession, took the Monetary Policy Rate (MPR) to 27.25 percent.

The naira fell to a low of N1658/$ on Wednesday even after the CBN signalled that market rates were going to rise in tandem with the MPR at a Treasury bill auction on the same day.

The stop rate on the one-year Treasury bill was 20 percent, up by over 1 percent from 18.5 percent at the last auction, while the rates on the 91-day and 182-day Treasury bill rose by 0.3 percent and 0.5 percent respectively.

The stop rate on the one-year bill takes the true yield to 24.9 percent, which despite being below inflation rate is the highest on record. Investor bids (N250.4 billion) amounted to 1.4 times the N173.8 billion of the one-year bill on offer.

Analysts say the CBN will be hoping the inflation-matching returns on the OMO bills will be enough to lure foreign portfolio investors into Nigeria.

The last time the CBN significantly raised the discount rate on its OMO bills in March, foreign investors poured in and the naira rallied, strengthening to a high of N1200/$.

In addition to raising the yield on OMO bills to a record high and allowing the Treasury bill stop rate to increase for the first time in three months, the Central Bank of Nigeria (CBN) announced on Wednesday that it will sell $20,000 to each Bureau de Change (BDC) at a rate of N1,590 per dollar.

The BDCs were mandated to sell at no more than 1 percent above the purchase rate. The dollar sale to BDCs is aimed at stabilising the exchange rate in the parallel market where the naira has also weakened considerably. The local currency however gained N5 on the parallel market commonly referred to as the black market on Thursday, closing at N1,695 as against N1,700 traded on Wednesday.

A pattern to the dollar sales

The CBN has intervened in the foreign exchange market multiple times this year but analysts say a lack of pattern to the apex bank’s dollar sales may be undermining its efforts to stabilise the naira.

The CBN sold $1.75 billion in the first seven months of 2024, according to data obtained from FMDQ’s website, but there was no clear pattern to the sales leaving the market guessing when the next intervention will come.

That uncertainty, according to some analysts, has contributed to the further depreciation of the naira which has shed over 70 percent since the CBN allowed the currency to float in June 2023.

Bismarck Rewane, an economist and CEO of Financial Derivatives Company Ltd, said that the CBN is leaving room for speculation by not clearly stating when it plans to intervene in the market and by failing to publish data on net external reserves.

“Bad news is better than no news at all,” Rewane said.

“By not stating the net position of reserves and not coming out to say this is when we will intervene in the market, you are giving room to speculation,” Rewane said.

“My view is that we should come up with a programme and be very clear about it. I believe if we take away the speculative premium, the naira could be trading at N1450-1500/$,” Rewane said.

Investors have taken data on Nigeria’s external reserves with a pinch of salt since the expose by American bank, JP Morgan, which revealed the government had far less than it published in net external reserves.

They question why the CBN is reporting a higher level of reserves at the same time the naira is tumbling.

“Surely, a central bank with $33 billion in reserves should have a better grip on its currency,” one investor who shared his scepticism on the external reserve data published by the CBN said.

“It is obvious the CBN does not have anything close to that in net liquid reserves,” the investor said.

CBN monetary tightening leaves businesses gasping for breath

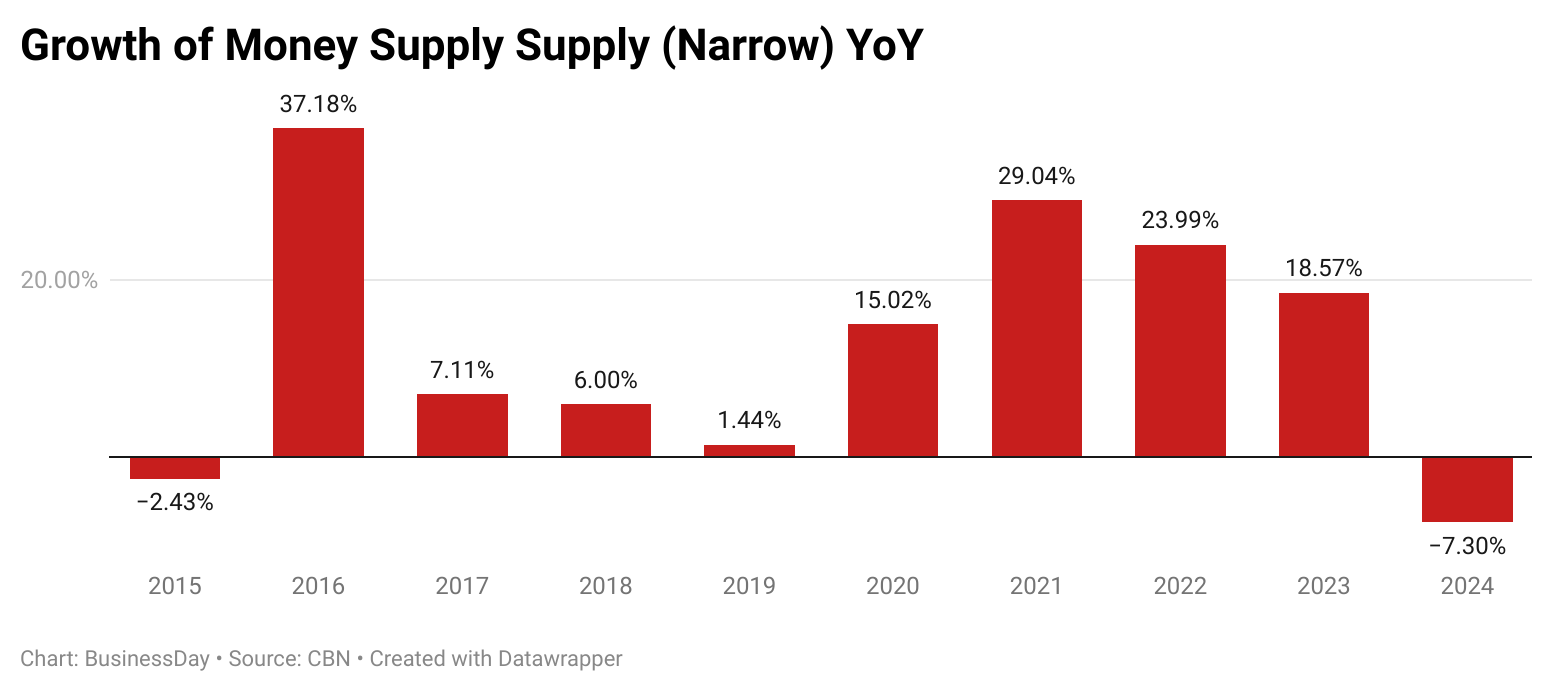

The CBN's efforts to combat inflation and shore up the ailing naira by increasing interest rates and raising the Cash Reserve Requirement (CRR) of banks by 500 basis points to 50 percent has its casualties- local businesses.

"The manufacturing sector, along with industries such as cement, food and beverages, chemicals, pharmaceuticals, and real estate, continues to face major challenges. This rate hike will only worsen their situation," Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise said.

According to Yusuf, tightening financial conditions amid the country's economic and structural challenges is a policy misstep.

Yusuf said that hiking interest rates and CRR translates to forcing the private sector to solely shoulder the burden of excess liquidity in the system, which is primarily driven by the public sector.