The Central Bank of Nigeria (CBN) appears to be losing the battle to stabilise the naira.

The currency has remained just as volatile as ever, despite the apex bank’s efforts to find a lasting solution.

The past week was a particularly volatile one for the naira and it took the intervention of the CBN to patch things up.

The naira fell by as much as 6 percent on Tuesday, making a mess of expectations that a surprise monetary policy rate hike by the CBN on that day would help the embattled currency.

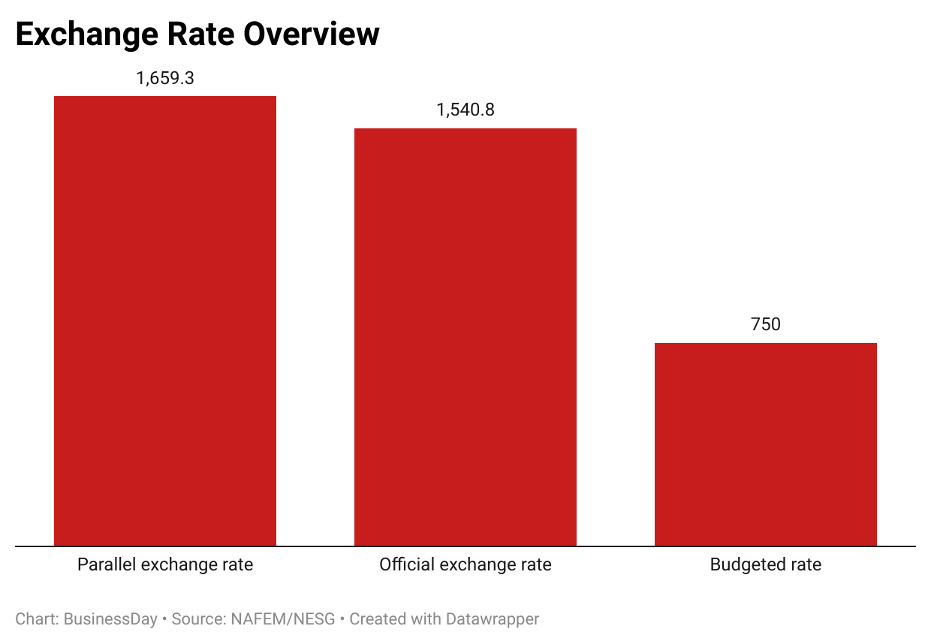

A dollar sold for as high as N1658.48 on the day compared to N1562.66 the previous day, according to data from FMDQ Securities Exchange.

The next day, the naira fell some more, touching a new low of N1667.42 before the CBN sold dollars to help the naira recover and end the week at 1540.78/$.

The naira hit a high of N1700 in intra-day trades last week, a sign of the increasing pressure on the currency. Traders say the intra-day rates are more market reflective than the closing rate.

Slippery slope

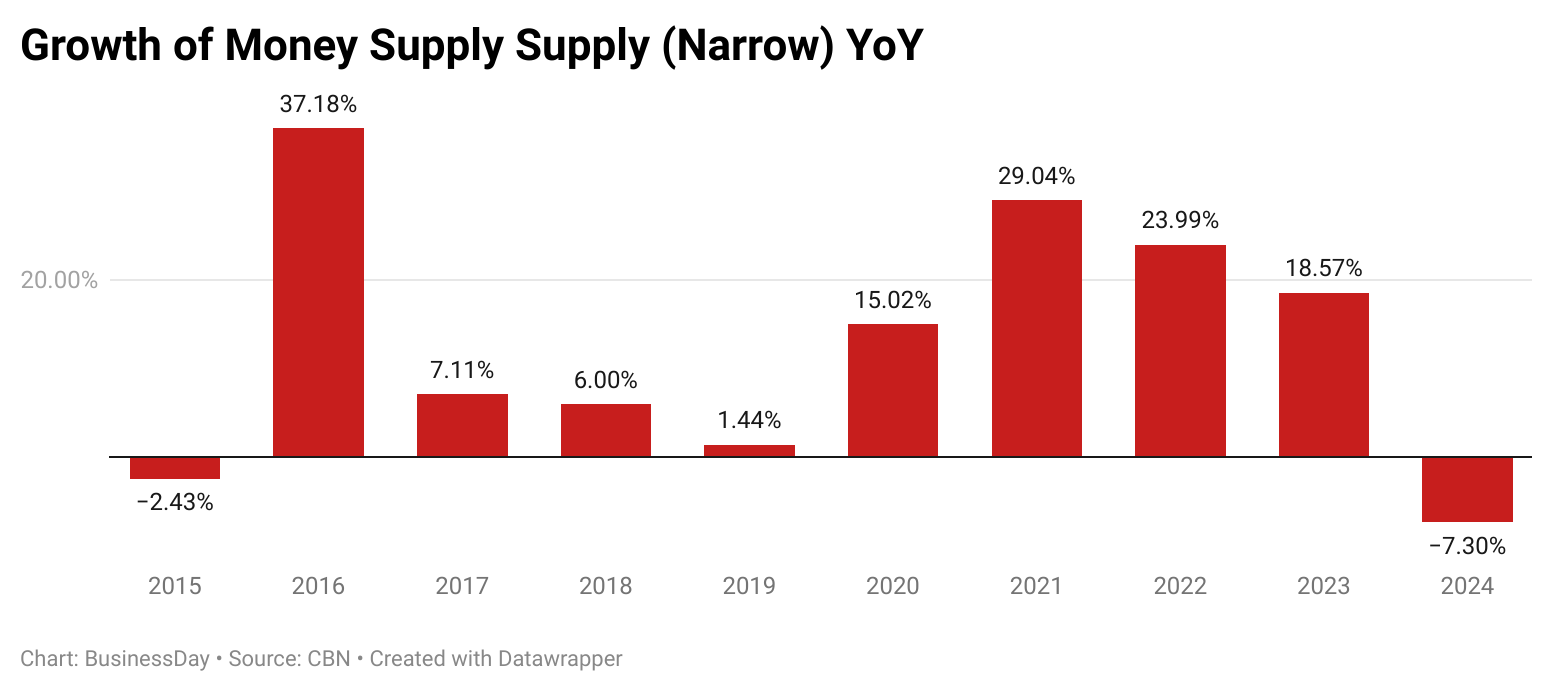

Despite a series of interventions, including surprise interest rate hikes, adjustments in foreign exchange policies, and attempts to increase liquidity, the naira continues its downward spiral, raising concerns over whether the CBN is losing the battle for the currency.

The naira has tumbled by more than 70 percent since monetary authorities allowed the currency to float against the dollar in June 2023.

The CBN has lost multiple battles to keep the naira stable since then.

The apex bank lost the battle to keep the naira at the initial N700 level which it was allowed to weaken to last year, before losing yet another battle to keep the rate at N1,200 towards the end of the year.

The battle to keep the rate at N1500 has been on for more than a month but there’s scanty evidence the CBN is winning that one with the naira occasionally slipping below N1600.

SOS

Olayemi Cardoso, the CBN governor, seemed to hint during the Monetary Policy Committee (MPC) meeting last week that monetary policy had reached its wits end in the battle to save the naira.

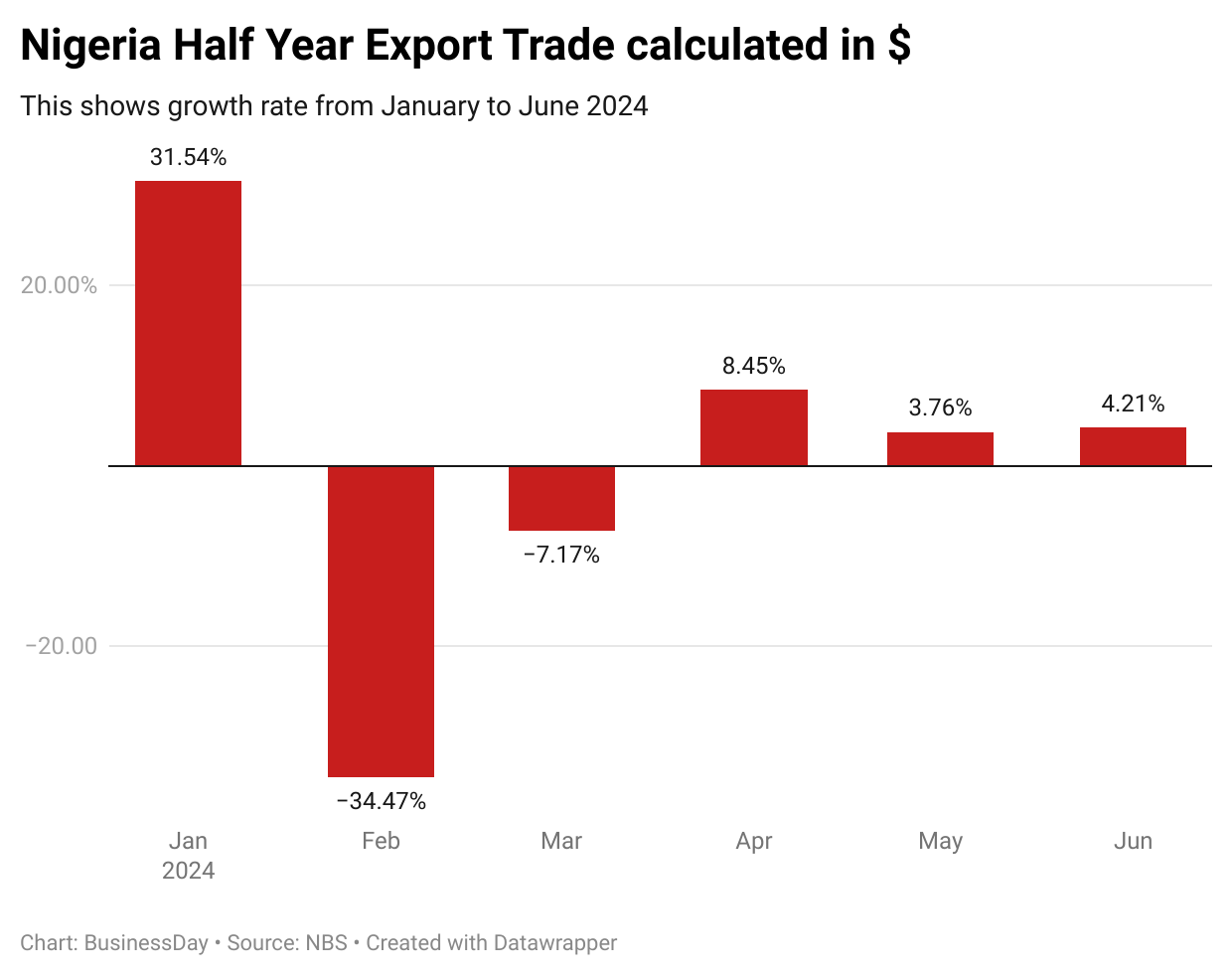

He urged fiscal authorities to boost oil and non-oil exports in a rare admittance that what the country needed to attract badly-needed dollars was now beyond monetary policy.

Market rates are being allowed to match inflation as the CBN favours orthodox monetary policy. The CBN sold Open Market Operation (OMO) bills last week at a yield of 32 percent, which is at par with August’s inflation rate.

Treasury Bill yields are also on the rise.

The CBN however knows it must be careful given that the last time it allowed yields rise rapidly to narrow the gap with inflation rate, there was inaction on the part of the government and that saw inflows slow and the naira weaken.

Foreign investors who had flocked in earlier made a killing by exiting when the naira lost its footing.

$10 billion out of sight

Wale Edun, the Finance minister, made repeated promises last year that the government had $10 billion in line of sight.

Edun’s statement appeared to be an acceptance that the only way of guaranteeing the success of the naira float was to attract sizable dollar inflows.

Rather than secure the $10 billion, Nigeria has had to make do with trickles that have only provided momentary relief for the naira before gains fizzled out.

Turning to the International Monetary Fund (IMF) seems off the table despite the argument by some economists that it is the only way out of the FX crisis in the short term.

Kingsley Moghalu, a former deputy governor of the CBN, has urged the government on multiple occasions to tap the IMF for a sizable loan in the region of $30 billion.

The longer the authorities weigh the options of how to stabilise the naira, the harder the pain the economy endures.

Nigeria’s economy is heavily reliant on imports, a reality that significantly impacts everyday life for most citizens. Many Nigerians find themselves at the receiving end of the exchange rate fluctuations that dictate prices for essential goods.

Every fluctuation in the exchange rate directly impacts daily life, driving up the cost of living.

Moreover, the structure of imports intensifies the situation. Industrial supplies account for 27 percent, capital goods for 23 percent, transport equipment and parts for 12 percent, and consumer goods for 7 percent.

Youth protests and brewing discontent in Nigeria find fuel in the dislocation blamed on the extreme exchange rate volatility. For instance, petrol prices have more than tripled since the government first removed fuel subsidies, exacerbating a cost of living crisis in Africa’s most populous nation.

Rising external reserves elude falling naira

In an ironic twist, even as the Naira continues to weaken, the CBN reports an increase in foreign reserves, raising a critical question: if reserves are on the rise, why does the Naira keep depreciating?

The CBN reports that Nigeria's foreign reserves grew to approximately $37.05 billion in July 2024, up from $34.70 billion the previous month.

On paper, this increase should signal stability, but the naira continues its downward slide.

Most of the problems begin with the lack of credibility of the external reserve figure, according to some investors.

“The CBN needs to publish the net reserve level if it is to give confidence to investors and should commit to scheduled interventions in the market,” a foreign investor who did not want to be named said.

Some economists are of the view that the CBN’s ability to intervene meaningfully in the foreign exchange market will be undermined as long as "speculative trading and high demand for foreign currency persist.

Monetary policy at wits’ end

The CBN has leaned heavily on monetary policy to combat inflation and stabilise the Naira, but this strategy seems to have reached its limits.

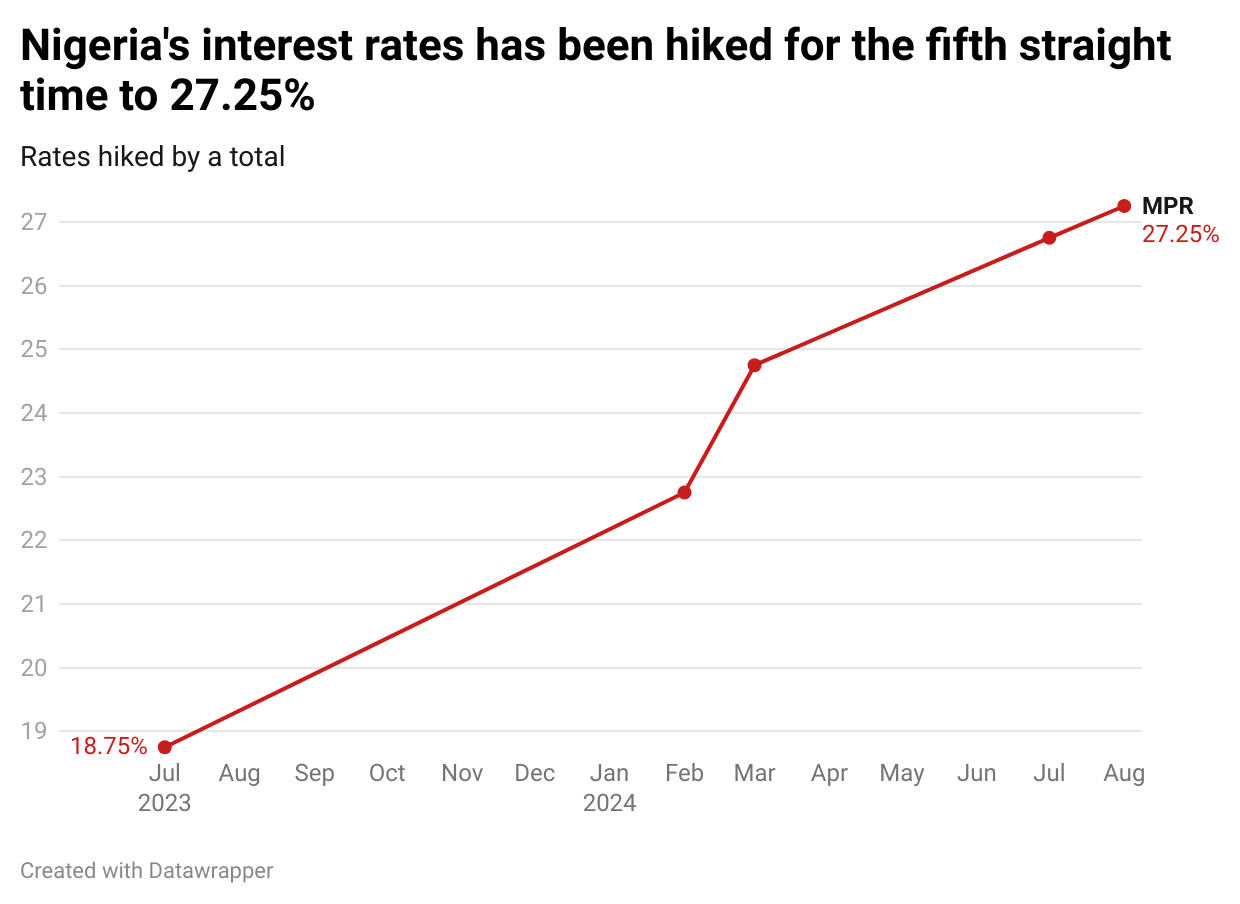

In September 2024, the CBN raised the Monetary Policy Rate (MPR) by another 50 basis points, bringing it to a historic 27.25 percent. While intended to curb inflation by reducing consumer demand, this decision has driven up the cost of credit, especially for small and medium-sized enterprises (SMEs).

Many SMEs, already burdened with high operating costs, are finding it increasingly difficult to survive. The steep borrowing rates—hovering around 32 percent—make expansion nearly impossible, leaving businesses teetering on the edge of closure.

As a nation that imports more than it produces, the question remains: how can Nigeria develop its production base when the cost of credit is prohibitively high?

This narrow focus on monetary tightening, without addressing the root causes of the Naira's volatility, threatens to push more businesses into insolvency, worsening Nigeria’s already precarious unemployment situation.

A change of tack

The CBN’s focus on raising the MPR has done little to stem the naira’s decline, despite showing some positive signs of controlling inflation. However, it is stifling economic growth and job creation.

By continually raising interest rates, the CBN is effectively pushing many businesses out of the credit market, leading to more job losses and further economic stagnation.

Rather than relying solely on interest rate hikes, economists say the bank needs to collaborate closely with fiscal authorities to address the underlying structural weaknesses in Nigeria’s economy—particularly the over-reliance on imports and the lack of diversification in foreign exchange sources.

A Coordinated response is key

Nigeria’s economic challenges cannot be solved by monetary policy alone. The country needs a coordinated approach that includes fiscal policy reforms aimed at boosting domestic production and reducing reliance on imports.

Investment in key sectors like agriculture, manufacturing, and technology could help create jobs and decrease the pressure on the naira by reducing the demand for foreign currency.

Additionally, addressing the country’s deep-seated corruption and inefficiency in governance could help restore investor confidence and attract much-needed foreign investment.