Nigeria is learning the hard way that when money supply is not able to match economic growth, there are consequences.

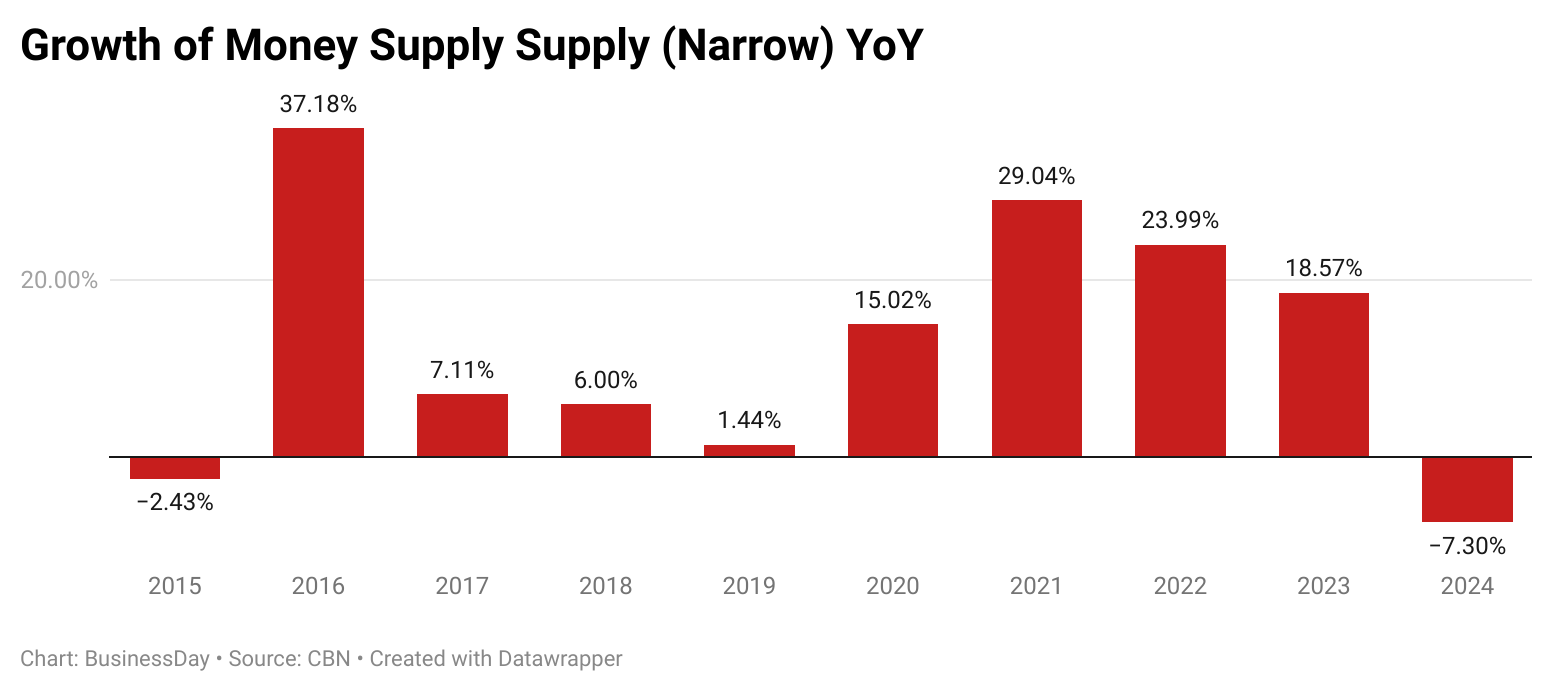

Nigeria experienced a dramatic increase in money supply through the Central Bank of Nigeria (CBN) between 2015 and 2023.

According to Olayemi Cardoso, the CBN Governor, the money supply stood at N19 trillion in 2015 and skyrocketed to N54 trillion in 2023.

While this represented an annual growth rate of 12 percent, the Nigerian economy only grew at an average of 1.9 percent during the same period. This disparity between money supply growth and economic performance raises important questions about the consequences of such an imbalance.

An increase in money supply typically occurs when central banks employ tools like lowering interest rates, "ways and means" financing as in the case of the CBN, or purchasing government bonds.

While this can inject liquidity into the economy and stimulate short-term growth, problems arise when money supply growth significantly outpaces the economy's ability to produce goods and services.

A cautionary tale of this can be seen in Zimbabwe during the early 2000s. Faced with mounting budget deficits, the Zimbabwean government dramatically increased the money supply.

However, due to poor economic management and declining agricultural output, the economy could not keep up. Inflation spiraled out of control, culminating in hyperinflation by 2008, with prices increasing at a staggering rate of 89.7 sextillion percent. This led to devastating consequences: people’s savings were wiped out, basic goods became unaffordable, and businesses collapsed.

The Zimbabwean dollar ultimately became worthless, and the economy was forced to rely on foreign currencies like the US dollar. The hyperinflation crisis triggered widespread unemployment, business closures, and a mass exodus of citizens seeking better opportunities abroad.

Zimbabwe’s experience illustrates the dangers of expanding the money supply without corresponding growth in productivity. As inflation rises, the most vulnerable groups, particularly the poor, suffer the most. Inflation has been called the "worst tax on the poor" because it erodes purchasing power, making necessities unaffordable.

In Nigeria, the effects of increased money supply have been similarly problematic. In 2023, the money supply hit its peak at 14 percent on a monthly basis, while inflation surged from 9 percent in 2015 to 32 percent in 2024.

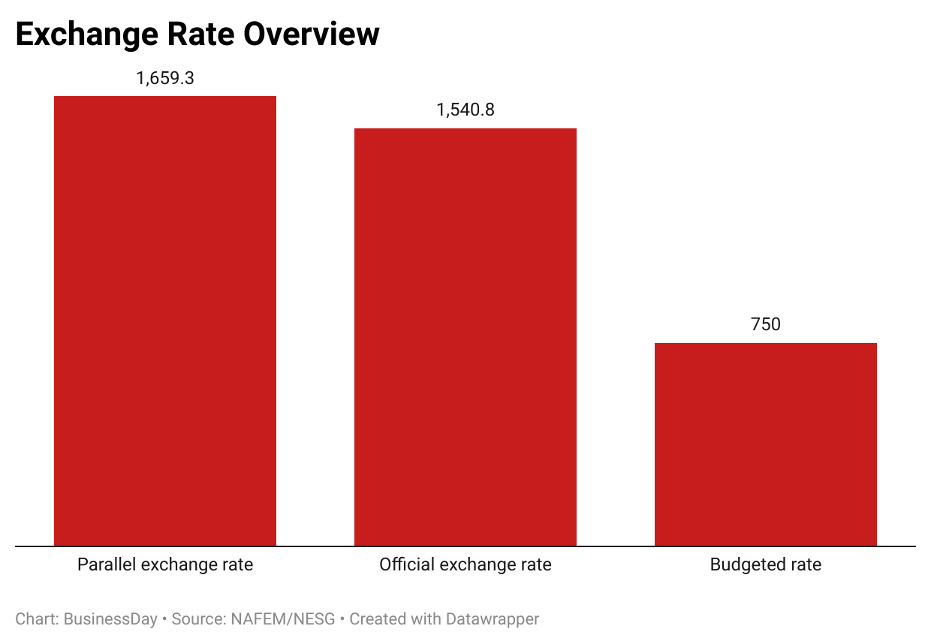

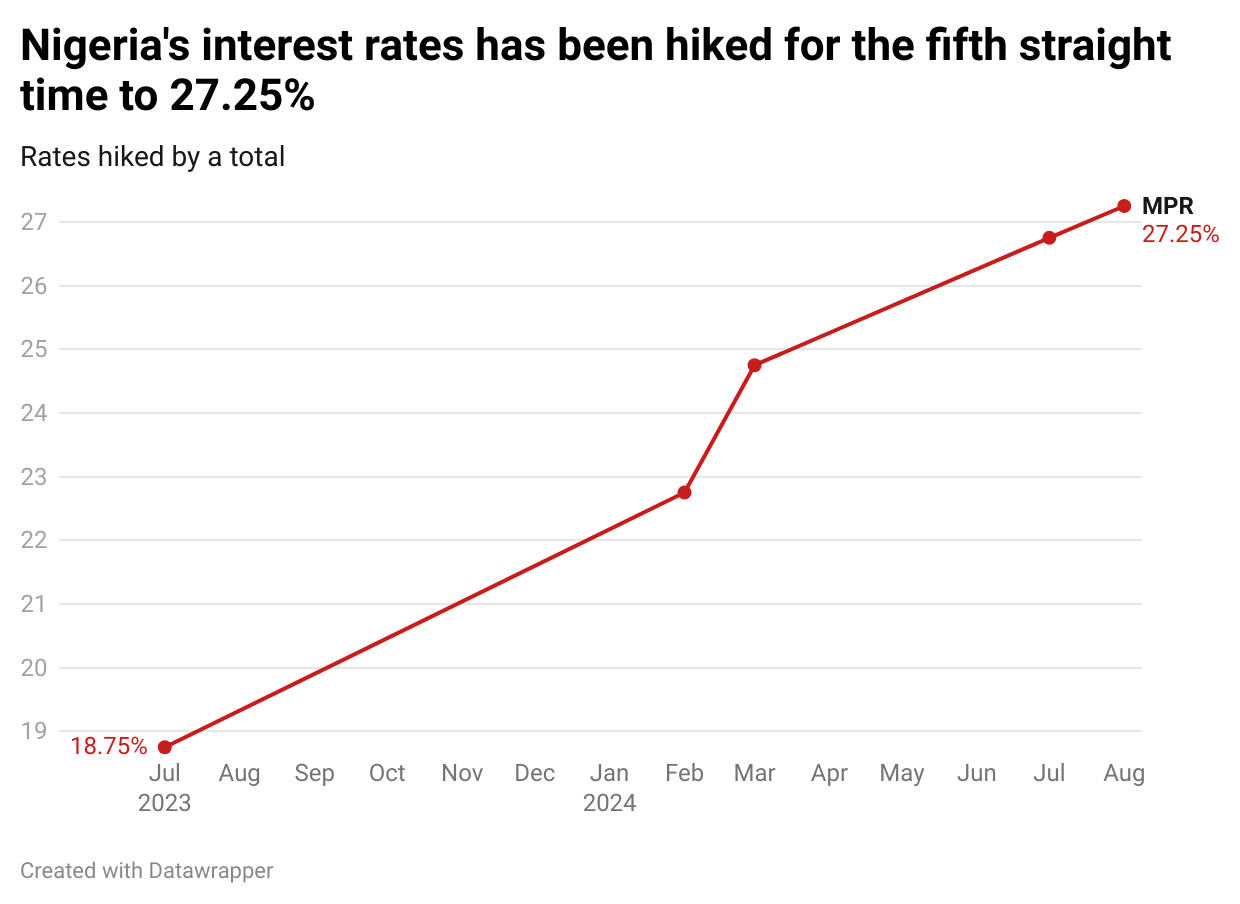

The gap between money supply growth and economic productivity is evident. While economic theory suggests that an increased money supply can lower interest rates, boost investment, and encourage borrowing, the benefits of such policies are undermined when the economy cannot produce enough goods and services to absorb the extra liquidity. In such cases, too much money chases too few goods, driving up prices and leading to inflation.

Despite the increase in liquidity, which should ideally stimulate economic growth by making it easier for businesses to access credit, Nigeria’s low productivity means the country has not been able to translate this monetary expansion into meaningful economic development.

According to BusinessDay analysis, between 2015 and 2024, the money supply grew at an average rate of 12.86 percent, with inflation by 16.56 percent, and interest rate by 14.43 percent, while the economy managed to grow at just 1.65 percent annually. This suggests that the Nigerian economy is not generating the necessary goods and services to keep pace with the rise in money supply, leading to inflation and a less productive economy overall.

Given the period under study, there is a seeming direct relationship between money supply, inflation rate, interest rate, and inconsequential growth in the economy.

The Nigerian experience serves as a reminder of the delicate balance between money supply and economic growth. Without policies that encourage productivity and economic diversification, an increase in money supply can lead to inflationary pressures, eroding purchasing power, and exacerbating poverty, especially for the most vulnerable.